September 5, 2025 • 11 min read

Step forward: Forge your future on the path to connected risk maturity

In an AI-powered business landscape where risks are emerging with greater speed, interconnectedness, and impact than ever before, organizations must equip their risk programs to be highly adaptive, responsive, and resilient.

A connected risk approach differs from traditional, siloed approaches in its focus on connecting an organization’s people, data, processes, and technology through a common risk and control language. Connecting risk across your organization fosters a unified understanding of enterprise goals across GRC and Audit teams, leading to more efficient risk management efforts, less redundant work across different departments, and risk-informed business decisions.

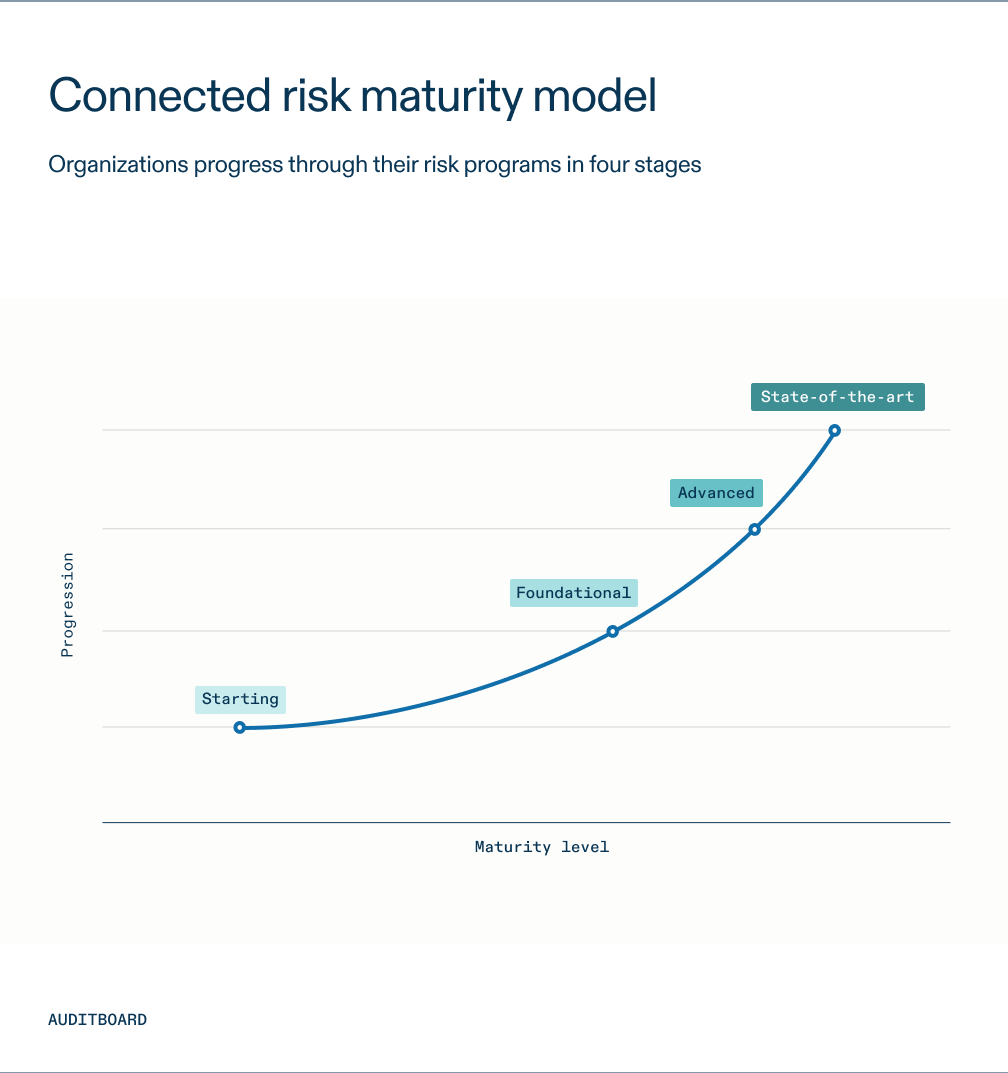

AuditBoard has identified four distinct stages of connected risk maturity for organizations seeking to understand their maturity: Starting, Foundational, Advanced, and State-of-the-art.

Starting

Reactive and siloed

Early-stage program with siloed audit, risk, and compliance teams relying on spreadsheets, disconnected tools, and fragmented risk and control libraries with limited connection to business priorities.

Foundational

Connected and Collaborative

Teams adopt a connected approach with a shared risk and control matrix, integrating modern risk technology, improving collaboration, and enabling basic automation across compliance activities.

Advanced

Agile and Data-Driven

Risk is proactively managed across teams, leveraging a unified data core, automation, and analytics to surface and mitigate risk faster. Seamless ecosystem integration and interoperability enable real-time data sharing and collaboration across business units and partners.

State-of-the-art

Predictive and Strategic

Fully connected risk and compliance teams are embedded in the business with AI-driven tools, advanced automation, and holistic insights fully utilized to predict, prevent, and dynamically address risk. AI continuously learns and adapts, driving strategic, real-time decision-making across the organization.

The four pillars of connected risk maturity

Where a business falls on the connected risk model depends on its performance across four individual pillars of connected risk maturity: executive sponsorship, risk team collaboration, data and technology readiness, and business alignment. Below, we define each of these four pillars and explore an example of how an AuditBoard customer exemplifies each pillar.

Pillar 1: Executive sponsorship

Executive sponsorship is a vital pillar of connected risk, signifying that risk management is a strategic business function championed by top leadership. When executives actively support risk, audit, and compliance programs, they help accelerate investment, align diverse teams, and increase the adoption of integrated platforms. AuditBoard assesses executive sponsorship maturity across four stages:

- Starting, where involvement is minimal and reactive

- Foundational, where leadership is aware but engagement is inconsistent

- Advanced, marked by active sponsorship often concentrated within specific teams

- State-of-the-art, where executives are visible champions, actively aligning GRC and audit priorities with strategic organizational goals to enable faster decision-making and enhance enterprise resilience

Customer Spotlight with Stellar Bank: Aligning leadership to drive scalable transformation

After a major merger, Stellar Bank's executive leadership actively united their three lines of defense and championed a strategic shift in risk management. Implementing AuditBoard as their central system for change management, executive leadership successfully shifted from reactive oversight to active governance. This coordinated, executive-sponsored approach helped support their strategy to grow beyond ten billion dollars in assets.

As one leader put it, “AuditBoard is our nervous system.” Read the full success story.

Pillar 2: ARC team collaboration

Audit, Risk and Compliance team collaboration is a cornerstone of connected risk, enabling high-performing teams to share insights, reduce redundancies, and align on enterprise priorities across functions and geographies. Team collaboration improves visibility, speeds up decision-making, and enhances confidence across the business. AuditBoard identifies four stages of maturity for this pillar:

- Starting, where teams operate in silos with minimal coordination

- Foundational, where collaboration has begun across two departments, but remains reactive or driven by a few individuals

- Advanced, where collaboration is integrated into regular workflows but may still depend on a few champions or specific areas

- State-of-the-art, where teams are fully connected, leveraging shared data, aligned roadmaps, and real-time insights to drive faster decisions, stronger assurance coverage, and strategically influence the entire enterprise

Customer Spotlight with Syniverse: Building a connected risk ecosystem

Syniverse transformed its audit, risk, and compliance programs by creating a connected risk ecosystem with AuditBoard at its core. Their GRC, security, and other teams now collaborate seamlessly, meeting bi-weekly to address current and emerging issues. By centralizing controls, policies, and frameworks, Syniverse eliminated duplicate testing and gained real-time visibility into risks — improving reporting efficiency by 40-50% and allowing them to handle the workload of an additional 1.5 full-time employees without increasing headcount.

Pillar 3: Data & technology readiness

Data and technology readiness form a critical pillar of connected risk, emphasizing the need for a unified data foundation and integrated technology to modernize risk management. This involves leveraging centralized systems, workflow automation, and intelligent analytics to help eliminate manual efforts, enhance visibility, and facilitate real-time decision-making across audit, risk, and compliance. AuditBoard outlines four stages of maturity for this pillar:

- Starting, characterized by reliance on manual methods like spreadsheets and disparate tools

- Foundational, where some technology is implemented, but processes remain inconsistent

- Advanced, where integrated systems are in use, leading to smoother data flow and consistent reporting, though fragmentation may persist

- State-of-the-art, representing a robust, real-time risk technology foundation supported by automation, analytics, and AI, enabling the organization to identify, prioritize, and act on risks with speed and precision

Customer Spotlight with Constellium: Centralizing data to improve visibility and scale

Previously, Constellium tracked audit and SOX data using spreadsheets and presentations, creating fragmented views and inefficiencies. By centralizing all risk and control information in AuditBoard, they were able to replace paperwork and scanned signatures with end-to-end transparency. Unifying their audit and control processes not only improved visibility and strengthened governance but also strategically positioned Constellium for future growth and digital transformation.

Pillar 4: Business alignment

Business alignment, a crucial pillar of connected risk, ensures that audit, risk, and compliance teams don't just provide assurance but actively drive strategy, accelerate execution, and bolster business resilience by connecting with broader organizational priorities. AuditBoard categorizes maturity in business alignment across four stages:

- Starting, where efforts are disconnected from strategy and focused on regulatory or operational tasks

- Foundational, where teams begin to support known risks and enterprise initiatives, but conversations remain siloed

- Advanced, marked by regular alignment with business planning cycles and key initiatives, though potentially varying across functions

- State-of-the-art, where audit, risk, and compliance teams are fully aligned and trusted partners, with their insights proactively driving strategic decisions, enterprise priorities, and transformation across the entire enterprise

Customer Spotlight with Humana: Connecting risk to business outcomes

Humana utilizes a connected risk approach to link risk insights to organizational goals, focusing on risk awareness rather than elimination. By ensuring business outcomes align with their risk appetite, Humana clarifies where to build resilience and where to strategically embrace risk for growth. Utilizing AuditBoard as a shared platform, Humana increased the number of SOX controls tested by 30%, completed 50% more risk audits, and boosted audit efficiency by 20% — empowering the team to expand coverage, enhance responsiveness, and foster confident business growth.

You may also like to read

Shadow AI: Audit privacy risks in your data supply chain

IT vendor risk management: Best practices for managing third-party tech risk

The ultimate vendor risk assessment checklist for compliance teams

Shadow AI: Audit privacy risks in your data supply chain

IT vendor risk management: Best practices for managing third-party tech risk

Discover why industry leaders choose AuditBoard

SCHEDULE A DEMO