October 26, 2022 • 4 min read

Integrating ESG for Value Creation: Developing Your ESG Audit Strategy

Organizations have experienced a surge in demand for better transparency regarding environmental, social, and governance (ESG) issues, compliance, and reporting. Motivated by climate change impacts, social movements, and global macroeconomic shifts, consumers, investors, and other stakeholders reexamined their expectations for how businesses can be held accountable for responsible ESG performance.

Audit, risk, compliance, and sustainability professionals have a critical role to play in responding to this surge. Both in the U.S. and globally, regulators are beginning to draft and implement more formal ESG performance standards — but many stakeholders are going a step further, pushing businesses to embrace ESG for value creation.

AuditBoard and Deloitte’s new guide, How to Audit ESG Risk and Reporting, explores how businesses can take an integrated approach to manage and report on ESG risk — and embrace ESG for its value-creating potential. Download the full guide here, and continue reading below for an overview of the growing importance of planning for ESG integration in an evolving landscape.

ESG Performance Is Business Performance

There are ever-increasing examples that ESG is being directly linked to business performance. As cited in Gartner’s “2022 Audit Plan Hot Spots” — which pinpoints ESG as a top-ten risk area for internal audit department focus in 2022 — over the past two years, double the institutional investors have committed to investing responsibly. They are incorporating ESG data into investment analyses and decisions. More creditors are issuing loans that adjust rates according to ESG performance.

In response to this increased financial impact of ESG on companies, financial reporting and accounting standard setters have made significant changes to their organizations. For example, the creation of the International Sustainability Standards Board (ISSB) and the merging of the Sustainability Accounting Standards Board (SASB) into the Value Reporting Foundation (VRF).

Many Organizations Still in Early Stages of ESG Readiness

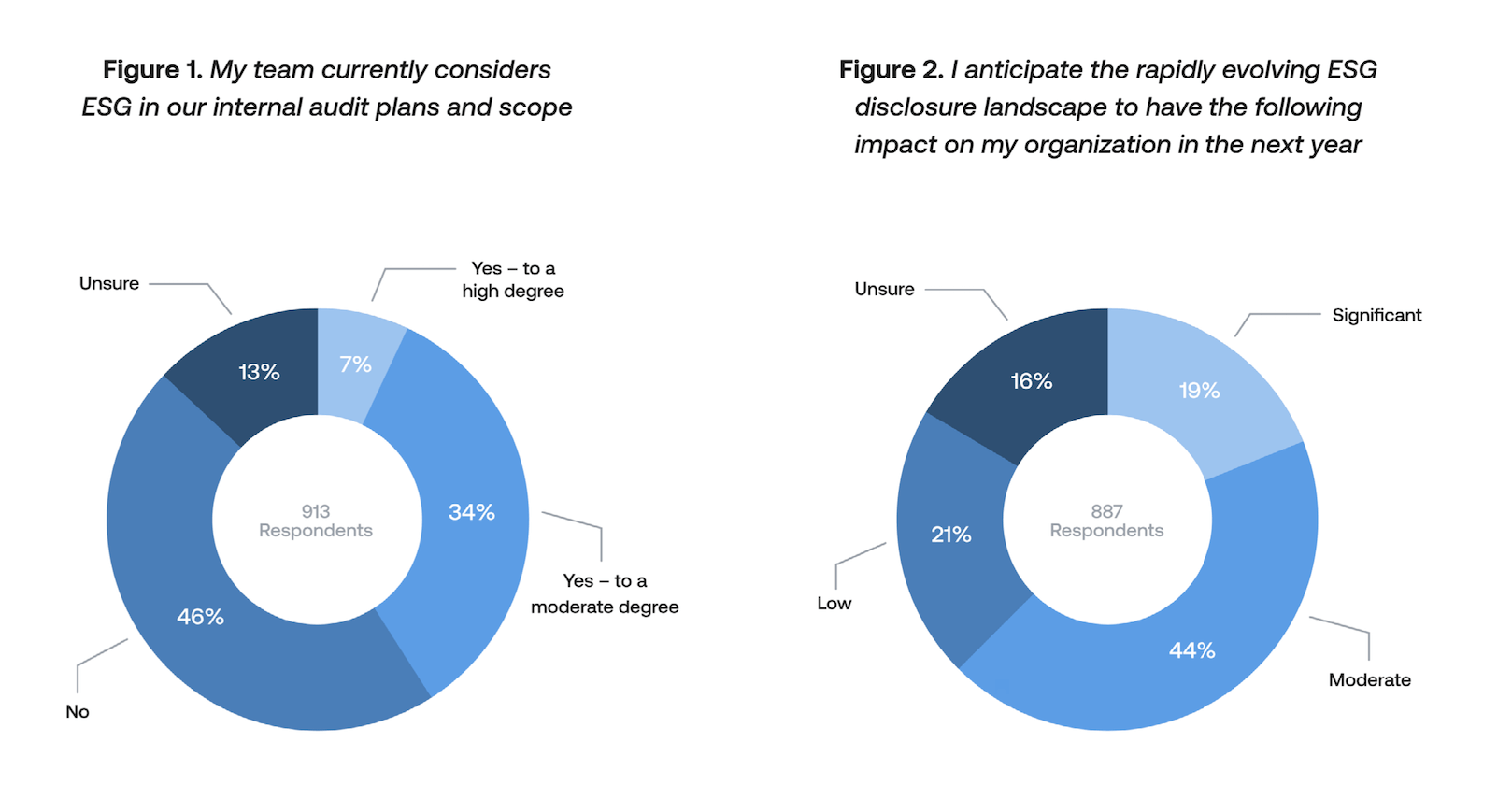

According to a 2021 AuditBoard survey of over 900 risk and compliance professionals across North America, more than 60% of respondents anticipated either a significant or moderate impact of ESG risk on their organization. Against this backdrop, however, less than half of respondents reported that they currently consider ESG in their internal audit plans and scoping.

ESG Integration Required for Better Performance and Resilience

The charge is clear: Organizations need to build and integrate ESG performance and resilience metrics into their corporate reporting. They must prepare to disclose relevant, transparent, and high-quality ESG information and the resulting financial impacts. Organizations must also integrate ESG considerations in a way that drives long-term value creation.

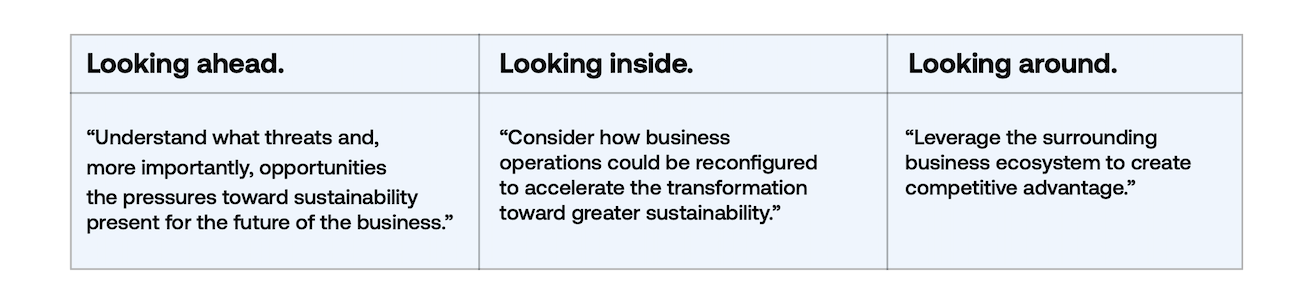

Deloitte’s “The Sustainability Transformation” identifies three far-reaching strategies, advising:

What does that mean for your business? It may be time to widen and extend your perspective, thinking bigger and longer-term about how ESG is reshaping your industry, business model, and future. Download AuditBoard and Deloitte’s new guide, How to Audit ESG Risk and Reporting, to learn more about integrating ESG into corporate reporting with an eye to long-term value creation.

You may also like to read

GDPR compliance requirements guide: What GRC managers need to know

How Cielo became the first RPO to achieve ISO 42001 compliance in just 3.5 months

8 best compliance automation tools

GDPR compliance requirements guide: What GRC managers need to know

How Cielo became the first RPO to achieve ISO 42001 compliance in just 3.5 months

Discover why industry leaders choose AuditBoard

SCHEDULE A DEMO