October 11, 2023 • 15 min read

Corporate Sustainability Reporting Directive (CSRD) Guide

Arsh Kaur

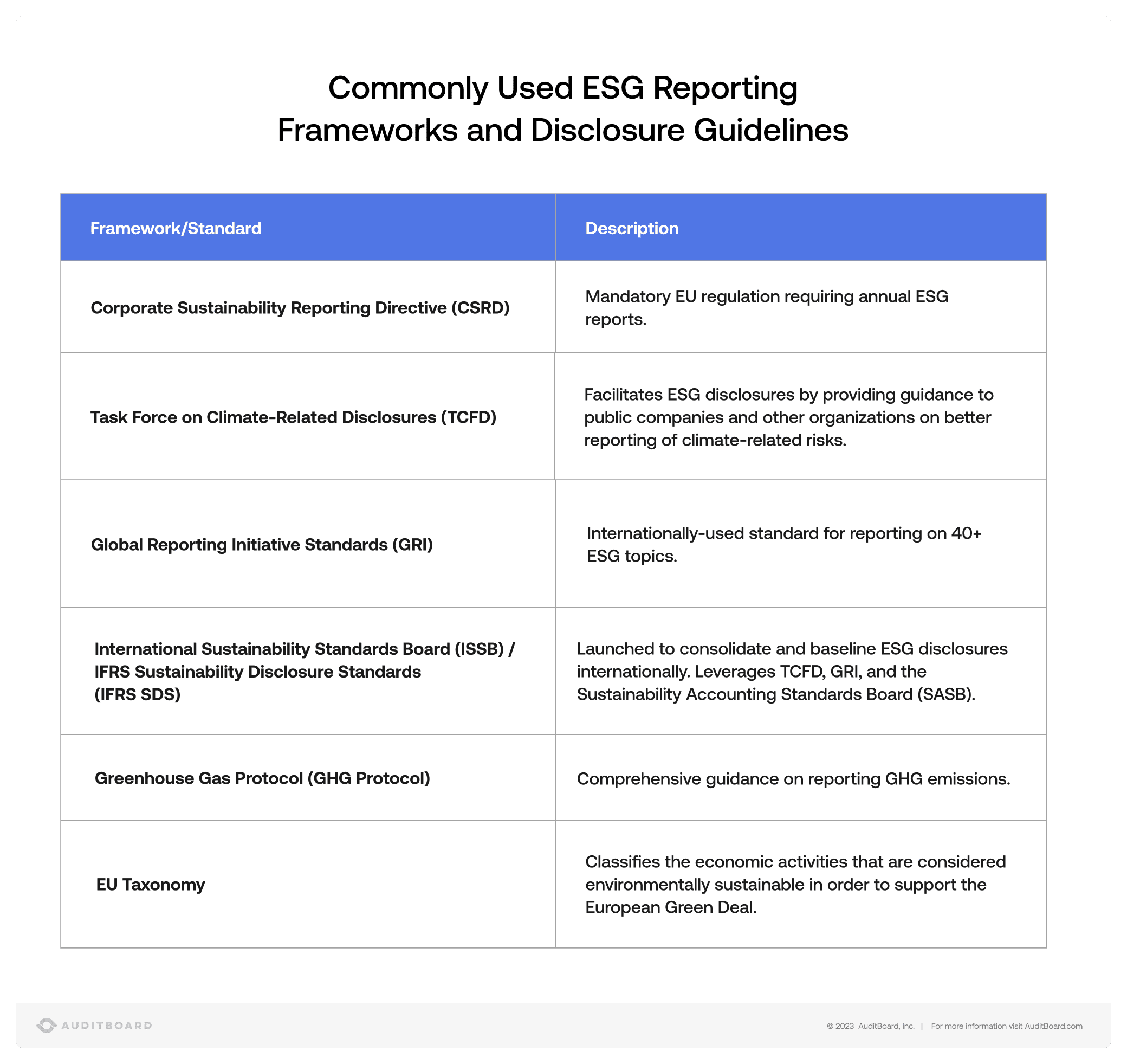

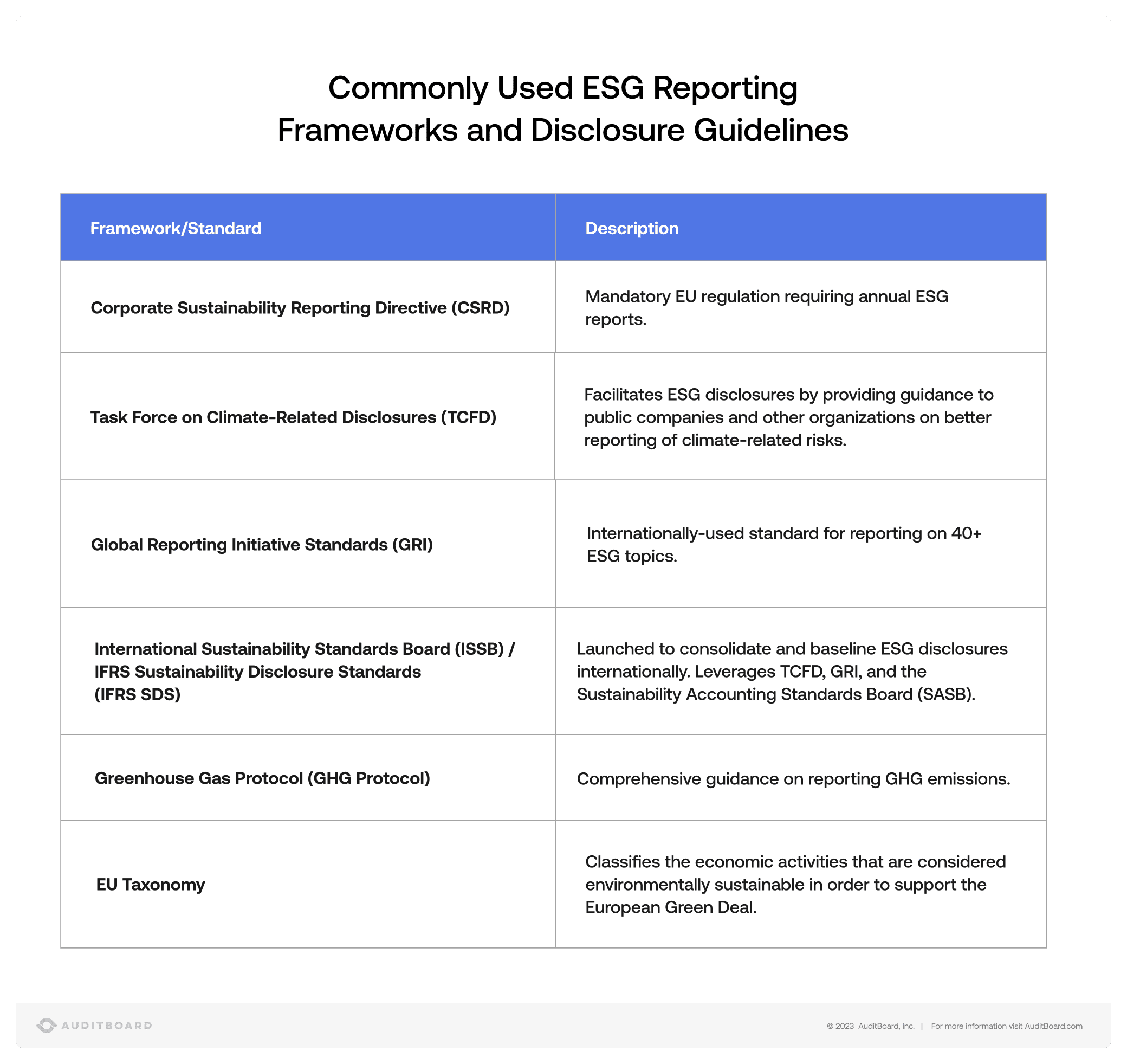

The evolving world of ESG reporting has launched many different frameworks and standards intended to address the environmental, social, and governance stance of organizations. In recent years, both the European Union and the United States have begun to move towards the consolidation of ESG reporting requirements, aiming for greater alignment across the field of disclosure requirements. The move towards consolidation is both timely and necessary in order to give companies, investors, and stakeholders a common set of criteria and expectations when analyzing sustainability information, social, and governance management reporting — and to simplify a complex alphabet soup of standards and frameworks.

“Greenwashing,” the misrepresentation of an organization’s ESG information, is another impetus for expanded regulations — stymying greenwashing and driving integrity and transparency is one of the objectives of the CSRD and other social and climate-related disclosure requirements.

With the Corporate Sustainability Reporting Directive (CSRD), which went into effect in 2023, the EU expanded on the existing Non-Financial Reporting Directive (NFRD), and made significant strides towards unifying ESG reporting standards, incorporating practices from the GRI, ISSB, and TCFD. The CSRD will be mandatory, and is expected to impact almost 50,000 EU companies and at least 10,000 non-EU companies.

The CSRD will start to be rolled out in 2024 through a phased approach. This directive is part of the European Green Deal, which is one of the priorities of the European Commission, the EU’s politically independent executive branch, and is an important component in reaching the goal of “Making Europe the first climate neutral continent in the world.” Although these specific standards seem to lean towards addressing sustainability issues only, it’s important to keep in mind that ESG reporting incorporates subjects such as human rights and executive compensation as part of social and governance considerations.

So, with new mandates in-flight and reporting obligations on the horizon, how can you and your company understand and get ahead of CSRD requirements? Read on, and we’ll cover the core principles of the Corporate Sustainability Reporting Directive, which companies need to comply, and how you and your organization can prepare for CSRD reporting.

What Are the Basics of CSRD?

We’ve thrown a lot of acronyms at you. The table above lists some key ESG frameworks and guidance, though for the purposes of the CSRD, the most important ones to pay attention to will be:

- CSRD: The Corporate Sustainability Reporting Directive, an EU regulation that requires eligible companies to disclose ESG metrics and information in annual reports that align with the European Sustainability Reporting Standards (ESRS).

- ESRS: European Sustainability Reporting Standards, which detail the reporting and disclosure requirements for companies that must comply with the CSRD.

- EFRAG: The European Financial Reporting Advisory Group, a private organization under the CSRD that provides technical advice to the European Commission and drafts the European Sustainability Reporting Standards for use in CSRD reporting.

The CSRD expands on the 2018 Non-Financial Reporting Directive (NFRD) with the twelve drafted European Sustainability Reporting Standards (ESRS), and increases the scope of disclosure requirements to include businesses’ supply chains and value chains. CSRD management reports will need to be issued annually, with the first set scheduled to cover the financial year of 2024, though the schedule may be subject to change. Member states of the EU will have a phase-in period to incorporate the CSRD into local and national laws.

The reach of the CSRD goes beyond the EU — any parent companies outside of the EU, but with EU subsidiaries or involvement in EU-regulated markets, may also need to comply with the sustainability disclosure mandates if they meet the eligibility requirements. This is expected to affect 10,000 or more non-EU-based organizations, which will need to begin initiatives to collect and analyze environmental, social, and governance-related metrics.

The CSRD will have both sector-specific disclosure requirements, such as for banking and financial services, infrastructure, and manufacturing, plus overarching common sustainability reporting standards. In addition to expanding on the previous NFRD, the updated Corporate Sustainability Reporting Directive also incorporates and integrates the EU Taxonomy system and the Sustainable Finance Disclosure Regulation (SFDR).

CSRD Eligibility Criteria

Not all EU organizations will need to comply with the CSRD, however large companies, regardless of whether they are public or private, will have to comply with the CSRD if they meet two out of three of the following criteria:

- The company has over 250 employees.

- The company has €20 million or more in total assets.

- The company has €40 million or more in net turnover.

Any non-EU undertakings that either generate EU revenues over €150 million or are EU-listed companies, EU subsidiaries, or have EU branches generating at least €40 million in revenue will need to release CSRD reports beginning in 2028.

Although CSRD reporting is EU-centric, some international organizations may opt to consolidate their ESG reporting into a global report that supports their business model.

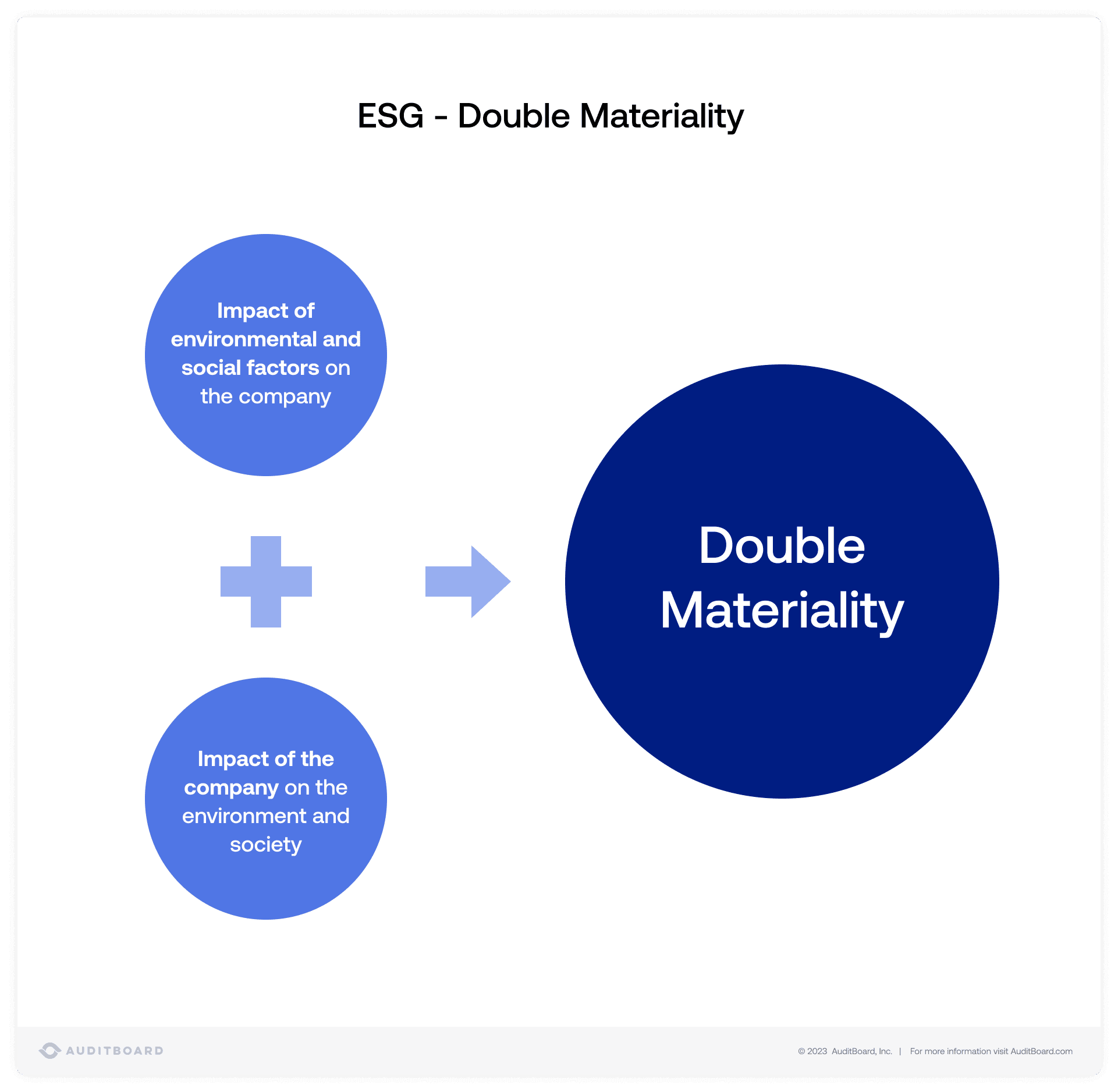

Double Materiality and the CSRD

From Limited Assurance to Reasonable Assurance

CSRD reports should begin to be issued in 2025, covering the previous year. However, recognizing that some businesses, especially smaller organizations, may need more time to meet the standard, the directive will be rolled out in a phased approach. Organizations already reporting on the NFRD may need to comply with the CSRD as soon as 2024, issuing a report in 2025. Companies not currently required to report on the NFRD, but that will be required to report on the CSRD, will need to issue reports starting in 2026, over the previous year. “Listed SMEs, small credit institutions, and captive insurance undertakings” will need to report in 2027 to cover the previous year.

The CSRD, crucially, introduces an assurance or independent third-party review requirement as part of the standard, unlike the NFRD in which third-party review was optional. In the interest of a phased approach, the CSRD permits for limited assurance in reporting until 2028, when reasonable assurance will be required (if deemed feasible by the European Commision).

What Are the European Sustainability Reporting Standards (ESRS)?

The Corporate Sustainability Reporting Directive requires businesses to create their EU sustainability reports in accordance with the European Sustainability Reporting Standards (ESRS) developed by EFRAG, and aligned with the EU Taxonomy. These disclosures should be integrated into the company’s management report, and will be publicly available.

The ESRS is based on the European Green Deal and is supported by the EU Taxonomy and the Sustainable Finance Disclosure Regulation (SFDR); it aligns with existing ESG disclosure best practices, like the TCFD’s recommendations and those developed by the GRI; and is the product of international cooperation with other standard-setting bodies like the ISSB.

The European Sustainability Reporting Standards break down disclosures into three topics,which should be familiar — environmental, social, and governance (ESG). Some general disclosures are also necessary, and these are referred to as “cross-cutting” standards. There are currently twelve ESRSs as of 2023.

General Disclosures

As part of the ESRS, and by extension, the CSRD, companies must include information about strategy, risk management, governance, metrics, and objectives, especially as they relate to ESG and sustainability matters. In this section, businesses are encouraged to demonstrate alignment with the EU Taxonomy and details about stakeholder and leadership engagement. An organization’s general disclosures must include the company’s materiality assessments using a double materiality approach, and justification for those designations.

Referred to as “cross-cutting” standards, there are two ESRS items that fall into this bucket,

- ESRS 1: General requirements

- ESRS 2: General disclosures

EFRAG provides detailed drafts for each of these ESRS items.

Environmental Standards

The Environmental Pillar of the CSRD includes five specific ESRSs:

- ESRS E1: Climate Change

- ESRS E2: Pollution

- ESRS E3: Water and marine resources

- ESRS E4: Biodiversity and ecosystems

- ESRS E5: Resource use and circular economy

As companies collect metrics and data to complete their ESG reporting, the CSRD asks them to set targets, measure baselines, and continuously report on progress. Information should account for historical data, forward-looking insights, and the end-to-end value chain. Compiling these types of disclosures can be a challenge for many organizations that do not have technical controls or systems in place to aggregate and analyze ESG-related data. Companies and their teams must consider what solutions and processes need to be implemented to adequately meet reporting directives like the CSRD.

Social Standards

There are four social standards included in the ESRSs, which examine the company’s impact on human rights, employees, the wider workforce, marginalized communities, customers, and other similar considerations — as well as the impact of society on the organization. These four ESRSs are:

- ESRS S1: Own workforce

- ESRS S2: Workers in the value chain

- ESRS S3: Affected communities

- ESRS S4: Consumers and end-users

Governance Standard

The Governance pillar of the ESRS has only one standard, but it covers topics from anti-corruption and bribery to policies and procedures. Both qualitative and quantitative measures are taken into account for this area, and figures like executive compensation may be included as part of the scope of disclosures. The lone standard in this category is:

- ESRS G1: Business conduct

Each of these twelve ESRSs have associated whitepapers made available through EFRAG, containing extensive guidance on reporting for each standard.

Enhance Your ESG Strategy Today

ESG reporting is a relatively new field of public disclosures that is only growing in importance. Investment choices increasingly hinge on ESG performance metrics, while consumers scrutinize a company’s global impact reporting on environmental, social, and governance topics can’t be ignored. Regulations like the CSRD will be put into place imminently, yet, collecting and analyzing ESG data remains a challenge. Beyond the data itself, companies face the added complexity of integrating this information with their broader audit, risk management, and compliance efforts. Thus, leveraging the right technology partner is crucial to efficiently navigate the ESG reporting landscape and ensure holistic alignment across your organization.

Purpose-built ESG technology can change the game for your team and your organization, providing the tools to collaborate, visualize data, and collect evidence in a single source of truth. By implementing the right platform, your organization can get ahead of the upcoming CSRD regulations and execute on a high-level ESG program.

Frequently Asked Questions About CSRD

What are the basics of CSRD?

CSRD stands for the Corporate Sustainability Reporting Directive issued by the EU, which will require companies to disclose environmental, social, and governance (ESG) information publicly based on the European Sustainability Reporting Standards (ESRS).

What are the European Sustainability Reporting Standards?

There are currently twelve European Sustainability Reporting Standards that provide guidance for reporting on general, environmental, social, and governance topics. The ESRS supports the CSRD.

About the authors

Arsh Kaur is a Principal Product Manager at AuditBoard focused on ESG Product Strategy. Prior to joining AuditBoard, Arsh worked in product management at Procore Technologies. Connect with Arsh on LinkedIn.

You may also like to read

GDPR compliance requirements guide: What GRC managers need to know

How Cielo became the first RPO to achieve ISO 42001 compliance in just 3.5 months

8 best compliance automation tools

GDPR compliance requirements guide: What GRC managers need to know

How Cielo became the first RPO to achieve ISO 42001 compliance in just 3.5 months

Discover why industry leaders choose AuditBoard

SCHEDULE A DEMO