The AI-powered connected risk platform

Break silos,

build resilience

AuditBoard’s AI-powered connected risk platform delivers a unified view of your business, embedding intelligence across your GRC teams to help you manage risk and unlock opportunity.

The AuditBoard advantage

Activate the front lines

Drive success from the ground up by creating a united force. With tools integrated directly into your workflows, you can tackle risks efficiently.

Arthur J. Gallagher & Co activates global risk management across three continents.

The platform for modern, connected risk

Risk management

Visualize and address every risk across your organization.

Risk management

Visualize and address every risk across your organization.

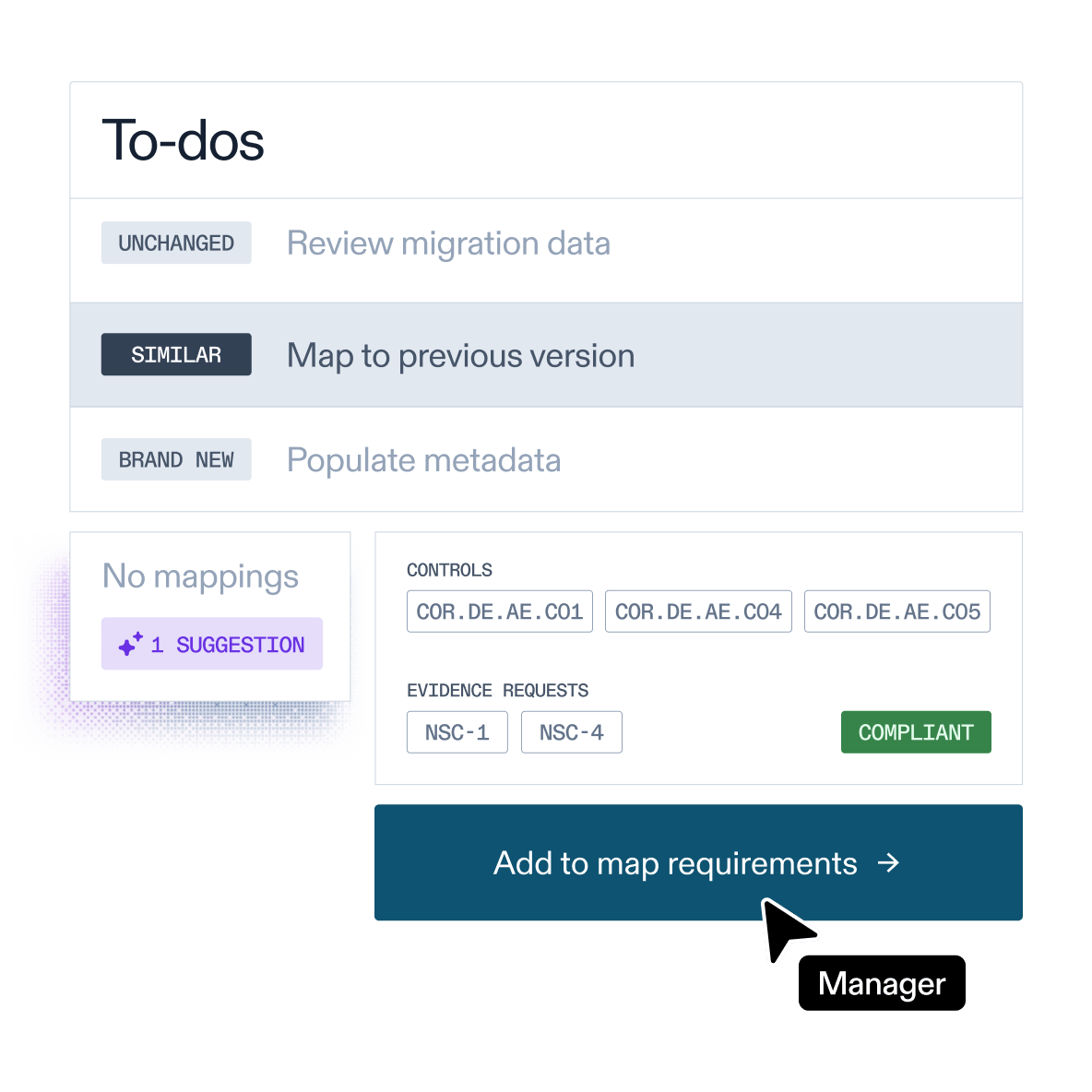

Regulatory & ESG Compliance

Stay on top of changing regulations with greater visibility and agility.

IT risk & compliance

Automate across each area of IT risk and compliance management.

Audit & controls management

Elevate your impact with risk-based auditing and SOX assurance.

AI-powered connected risk for practitioners, by practitioners

Our platform was built with you and your teams in mind — which is why our tools empower you to scale efficiently, reduce manual effort, and stay ahead in today’s dynamic risk landscape.

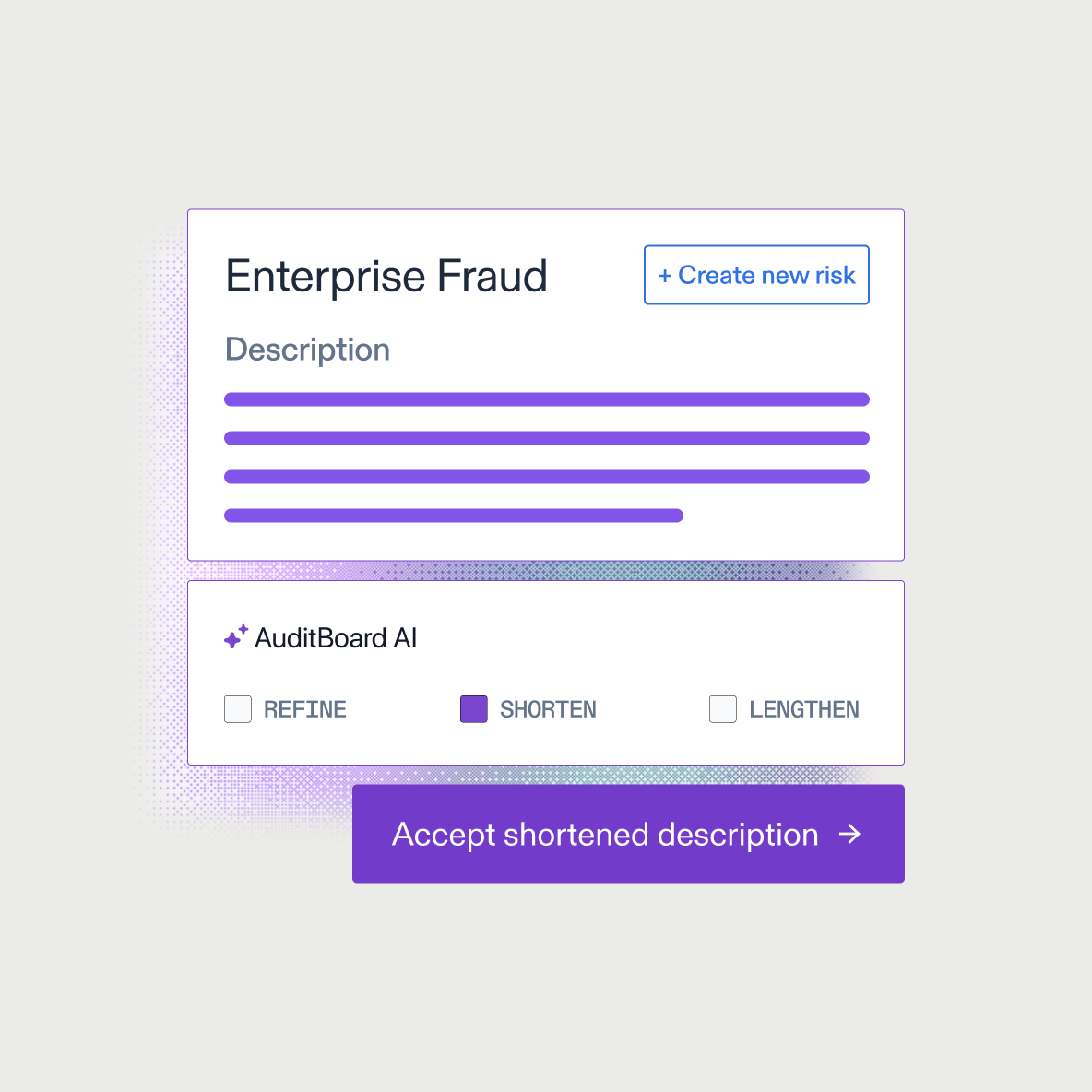

Accelerate with AI

AuditBoard AI delivers insights and optimized models designed to tackle risk and compliance challenges. Our GRC-trained AI helps you uncover valuable insights. With configurable oversight and full audit trails, AuditBoard AI is designed to provide intelligent assistance while keeping you in control.

Flexible reports for faster decisions

Access customizable reporting tools alongside out-of-the-box dashboards to easily uncover insights, track trends, and make data-driven decisions.

Ensure continuous compliance

Stay audit-ready as your organization scales by using a preloaded library of 30+ frameworks, including SOC 2, ISO 27001, and GDPR.

Integrations for your workflows

AuditBoard’s integrations and APIs streamline data collection, task management, and more with seamless connections.

Scale testing, simplify compliance

AuditBoard Analytics evaluates entire data populations, streamlines workflows with templates, and enables continuous monitoring for year-round risk coverage.

The value of connected risk

Discover how a connected risk platform can impact your team’s efficiency, compliance, and visibility.

0%

more efficient control mapping*

0%

more efficient real-time data reporting*

0%

deeper understanding of risks*

Maximize impact with end-to-end support

AuditBoard experts

Partner with AuditBoard’s team of former practitioners, platform experts, and industry leaders to achieve rapid time to value.

On-demand training

Drive platform adoption, implement best practices, and upskill with on-demand training and certifications.

Connect with community

Join a community of 9,000+ power users sharing tips for maximizing impact at every step.

See why 140,000+ GRC leaders love AuditBoard

“AuditBoard has helped us streamline processes across different teams and modules. We've customized it to be exactly what we want with the help of AuditBoard Academy.”

Katelynn Matt, IT Controls Analyst, United Wholesale Mortgage

“I love how the modules work seamlessly together to provide a unified view of the company's risk profile. It has replaced all the spreadsheets used in the past.”

Cindy Kwan, Director, Internal Audit, Workday

“AuditBoard’s user-friendly interface and centralized dashboard offer clear visibility into GRC activities, making it easy to track audits, assess risks, and ensure compliance.”

Adam Hardy, CPA, Internal Audit Manager, Helmerich & Payne

“What’s most helpful about AuditBoard is the dedication to educating its users and reflecting that education through product updates and regularly scheduled webinars.”

Kimberly Rich, Vendor Risk Manager, Camping World

Experience the power of connected risk today

Schedule a Demo