July 10, 2025 • 20 min read

Risk quantification: Methods, metrics & business impact

Alan Gouveia

Risk management leaders are under pressure to do more than identify threats. They need to justify priorities with hard data that stands up to scrutiny. Board members and business partners want answers, not gut feelings. Which risk deserves investment? How much loss exposure could a threat create? What happens if an incident lands tomorrow?

These are not academic questions. They shape where resources go and how resilient your company can be. Yet, many risk owners still rely on qualitative assessments and “heatmaps” that leave decisions open to debate.

The reality: quantifying risk is no longer optional. Moving from qualitative judgment to quantified risk metrics allows teams to prioritize based on financial loss, communicate confidently with executives, and directly tie risk management to business objectives. Companies leading this shift don’t wait for perfection or complex frameworks — they use the data they have, building toward maturity step by step.

This article breaks down what risk quantification really is, how your team can start or advance your journey, and why the payoff is more than just better reports. You’ll see how quantifying risk promotes better decision-making, wins executive buy-in, and aligns risk management with the metrics the business actually cares about.

Understanding risk quantification

Risk quantification means putting a number to uncertainty. Instead of describing risks as “high,” “medium,” or “low,” teams estimate potential losses, probabilities, and financial impact in clear, defensible terms — often in dollars. It moves risk management from a matter of gut feel to something you can explain, defend, and act on.

This shift from “high, medium, low” to actual numbers can be a game changer for teams. Below, you’ll find an illustration that lays out the differences between qualitative, semi-quantitative, and quantitative risk assessments. It highlights how each step adds more clarity, so it’s easier to see what you’re really dealing with and what matters most.

Why does this matter? When you stick to categories and color-coded charts, it’s tough to agree on priorities. One person’s “high” might be another’s “moderate.” But when you put real numbers to each risk — even a rough estimate — you make it clear which problems deserve attention, which can wait, and how much should be invested to reduce exposure.

Quantification starts simple. Scoring models or basic dollar estimates are often enough to create new clarity. Teams mature over time, building toward more detailed risk models, such as Monte Carlo simulations or frameworks like FAIR. What matters isn’t having a perfect system; it’s giving decision-makers information they can act on that’s grounded in facts.

No matter where you start, the goal stays the same: Make risk easier to explain and easier to use as a basis for decisions.

Risk quantification myths that are holding teams back

Teams know that better decisions come from clarity, but several persistent myths still slow down progress. Breaking these cyber risk quantification myths is the first step toward a more confident, data-driven risk program.

Myth 1: “We can’t start quantifying risks until we finish implementing FAIR.”

Factor Analysis of Information Risk (FAIR) is a highly useful quantitative risk analysis model that represents an excellent framework goal for businesses to work toward. However, it’s often misrepresented as a barrier to entry for risk quantification. The idea that you can only quantify your risks upon finishing FAIR implementation is a limiting myth, especially since FAIR is a time-consuming process that can stretch out for a year or more.

Infosec teams in the process of implementing FAIR need not wait until its completion to begin quantifying their risks. Consider this: If it takes you a year to get up and running in FAIR, what critical IT risks would you have failed to properly assess and communicate to the business in that time?

Risk quantification is an iterative process that builds upon qualitative risk data your organization already has access to. So, it’s possible to begin quantifying and managing risks without using FAIR — or even while preparing for FAIR.

Bottom line: Teams can, and should, begin using data gathered from their qualitative risk assessments to quantify their information security risks, regardless of whether they use FAIR.

Myth 2: “We don’t have the time or resources for FAIR, so we have to put risk quantification off for now.”

The reality is that some information security (infosec) teams may not have the time, resources, or desire to implement FAIR in the foreseeable future. However, these infosec teams stand to lose out on the opportunity to provide essential risk information to executive leadership in the days, weeks, and months until they’re “ready” for FAIR.

There are many paths to risk quantification. Even if your business isn’t yet ready for FAIR or has no plans to implement the methodology, infosec can take steps to begin quantifying your risks. Remember that risk quantification follows a maturity path.

Bottom line: The most important directive is to take the opportunity to glean value from each risk quantification step that can and should be taken before even starting the FAIR framework.

Myth 3: “It’s not a good time to get started because we’re not sure what the best approach is.”

In this case, perfect is indeed the enemy of good. If you can’t effectively quantify and communicate your IT risks to leadership, your IT assets will become vulnerabilities, and any existing risk mitigation efforts will suffer. Putting off getting started is the riskiest choice of all. If you let the notion of “waiting for the right time” take hold, you lose opportunities to make risk-informed decisions in the present.

Rather than get caught up in semantics and debating the pros and cons of “qualitative” and “quantitative” risk assessment, reframe your understanding of risk quantification. Risk quantification builds upon any qualitative risk assessment your business currently performs. The turn of phrase “building the airplane in mid-air” applies here. Get comfortable with building your risk program while assessing and evaluating your risks — and don’t let the idea of “perfection” prevent you from starting.

Bottom line: What’s most important is getting started as soon as possible to avoid missing opportunities to provide critical risk data to leadership and begin managing key risks.

The maturity spectrum of risk quantification

Building a risk quantification program is a process — progress typically occurs in steps, rather than all at once. With each new layer of detail, you give decision-makers more clarity and reduce the guesswork that can muddy risk conversations.

Qualitative foundations and basic scoring models

Many teams start simple: You gather what you know and assign scores based on likelihood and impact, sometimes multiplying those numbers for a quick risk ranking. It’s a helpful starting point and brings structure to what can feel like a moving target.

But when you try to compare risks across the business — especially when some have high stakes and others are just more common — the need for a better approach quickly becomes clear.

This method is a foundation, but it doesn’t always provide the context leaders need. Explaining why a rare but expensive risk should be prioritized over a frequent nuisance requires a clear story (not just numbers).

Semi-quantitative risk approaches

As teams build experience and gather more input, their approach improves. Key improvements include:

- Breaking out losses by range or scenario instead of blanket scores

- Separating risks that could trigger six-figure losses from routine operational hassles

- Tying criteria to what actually moves the business, not just abstract probabilities

This progression is often driven by input from across the organization. When process owners, IT, finance, and operational leads weigh in, you get a fuller sense of what a risk means in the day-to-day. You can also start connecting what you measure with key risk indicators (KRIs) and broader business objectives, so your reports help guide real decisions.

Advanced quantification (e.g., FAIR, Monte Carlo)

Some programs invest in advanced methods that bring even more detail to the table. With frameworks like FAIR, you can:

- Break down risks into their core components (event frequency, threat strength, potential losses)

- Put credible dollar figures to each scenario

- Guide strategy and inform insurance decisions

- Justify investments with concrete specifics

Monte Carlo simulations go deeper, running the data through thousands of possible outcomes to show the full range of potential risks. This gives leaders a realistic sense of both likely losses and potential worst cases, helping teams ask better questions and make stronger choices.

Advanced methods require dedicated data, tools, and time. But reaching this level means your risk program is built for business impact, not just compliance. Finance, operations, and executives can use your numbers to challenge plans, vet priorities, and move forward with confidence.

You’ll see these progressions in organizations focused on scaling risk programs, especially as quantification becomes central to decision-making for strategy, planning, and reporting. Mature programs don't waste time on manual processes. They use automation to handle routine risk assessments and apply mitigation strategies consistently, freeing up analysts to focus on interpreting results and making decisions.

Business value of quantifying risk

Putting numbers to risk changes the conversation. Suddenly, decisions are grounded in facts, not opinions. Leaders and teams get a clearer sense of what’s urgent, what can wait, and what each risk means for the business.

In Gartner’s 2023 Peer Insights survey, 97% of leaders whose organizations have adopted CRQ report positive organizational benefits. It’s a signal that quantification delivers real-world gains, from stronger decisions to sharper board conversations.

Enabling informed decision-making

When risk is measured in real terms — like potential loss or business impact — choices become much simpler. It’s easier to focus on what matters when you know the likely size and shape of a problem. This makes discussions more productive and helps teams align on prioritization faster.

For instance, comparing the estimated cost of a rare outage with the impact of ongoing operational risk lets the business see which issue deserves immediate attention. Quantified data also makes it easier to weigh the pros and cons of investments in controls or mitigation. The conversation shifts from “what feels big” to “what actually costs us.”

Gaining executive buy-in with financial metrics

Bringing risk into financial language opens doors with leadership. Boards and executives are used to thinking in terms of dollars, likelihood, and return on investment. When risks are described this way, it’s much more straightforward to make the case for action, whether that’s funding a new control, updating insurance, or changing a process.

Risk quantification also helps translate abstract scenarios into something concrete. Instead of a red, yellow, or green status, leaders see real numbers that help them understand trade-offs, building trust and making approvals easier.

Cyber risk management benefits most from this approach. Instead of drowning in technical details, executives finally see what cyber threats cost in dollars and cents.

Communicating risk appetite and priorities

Not all organizations have a defined risk appetite, but most want to establish clear boundaries for what they'll tolerate. Quantification provides the tools to set these boundaries using:

- Real figures instead of vague guidelines

- Clear thresholds everyone can understand

- Concrete limits that simplify coordination and decision-making

Aligning priorities gets easier too. Risk, compliance, and operational teams can use the same data points, talk in the same terms, and move together as strategies shift. When measuring risk becomes part of regular business conversations, focus (and credibility) improves throughout the organization.

As risk quantification becomes more routine, it naturally finds its way into planning, reporting, and everyday decision-making, making priorities clearer and strengthening buy-in across the business.

Smart teams use quantification to strengthen their GRC programs. When governance, risk, and compliance teams speak the same data language, they focus on specific threats that could impact revenue or operations.

How AuditBoard helps teams quantify risk

Quantifying risk gets easier and more valuable when you have the right tools. AuditBoard gives teams what they need to move beyond spreadsheets and manual scoring, making the process more accurate, dynamic, and connected to business objectives.

"AuditBoard has helped us address risk and drive consistency. Our overall company strategy - and one of the big messages from our CEO - is to do the right thing always. Having AuditBoard gives people the visibility into what's expected and helps them really understand what the values of the company are and why we're doing things." — Alex Byrne, Director of Internal Audit, Watts Water

Build and customize scoring models

Every organization has its own risk landscape. AuditBoard lets you design scoring models that reflect how your team thinks about risk, from simple scales to more advanced frameworks. You can track likelihood, impact, and other key criteria in one place, with flexibility to adjust as your program matures.

The benefit: you create clarity and consistency, using models your team actually understands and adopts. Changes and improvements are easy to roll out, so your approach stays current as your business evolves.

Link risk to business objectives and KRIs

Risk management doesn’t exist in a vacuum. With AuditBoard, teams can connect risks directly to business objectives and key risk indicators (KRIs). This means you don’t just report “what’s risky” — you can show why it matters for business success. Links to objectives and KRIs help you spot trends, focus mitigation efforts, and keep leadership conversations on what counts for the organization.

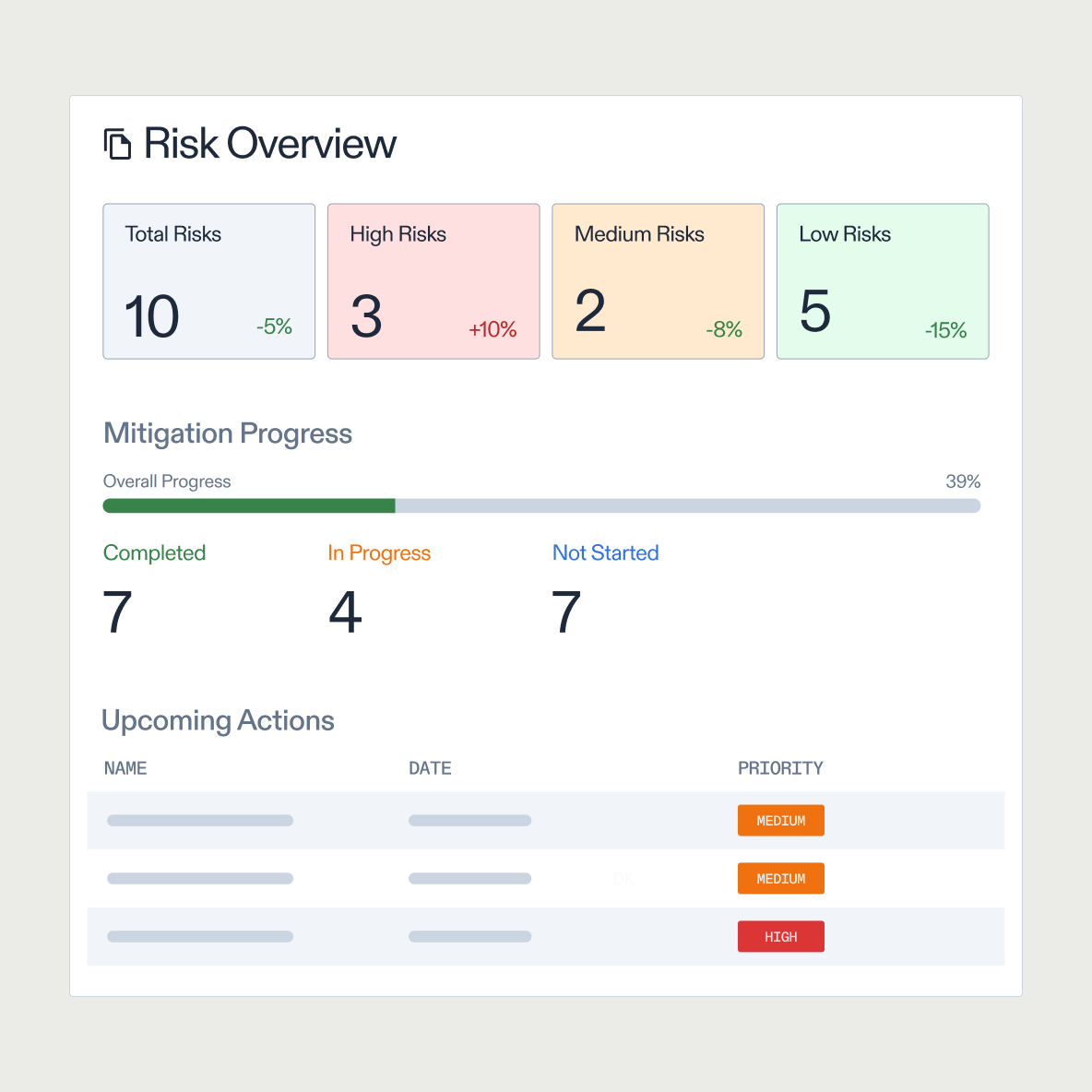

Monitor risk in real time with dynamic dashboards

Static reports don’t cut it when the risk environment is always changing. AuditBoard’s dynamic dashboards give teams a live view of risk exposure, with the ability to monitor trends, drill down to root causes, and respond quickly as new data comes in. You can share insights with leadership and make adjustments on the fly, helping everyone stay informed and proactive (versus reactive).

For organizations ready to make risk quantification a core part of their risk management strategy, AuditBoard’s integrated platform offers risk solutions that put actionable data at the center of the program.

Time to get started

Risk quantification isn’t reserved for big enterprises or fully mature programs. It’s a mindset shift, choosing to ground your priorities in data you can explain and defend. Whether you’re just moving away from gut feel or you’re refining advanced models, the most important step is to start from where you are. Build on what you already know, adjust as your business changes, and don’t wait for a perfect framework before taking action.

Security teams that move forward see clearer priorities and stronger buy-in at every level. As risk becomes easier to explain, leaders respond faster, and support grows across the business.

With the right process, and the right platform, risk quantification turns uncertainty into an advantage. AuditBoard helps teams link risk data to business strategy, monitor progress in real time, and communicate confidently with stakeholders.

The platform's integrations with other business systems ensure your risk data flows seamlessly into decision-making processes (like managing cybersecurity risk). If you’re ready to see how quantification can work for your organization, request a demo and take the first step toward more informed, data-driven risk decisions.

About the authors

Alan Gouveia is Head of Customer Experience, CrossComply at AuditBoard. Alan has worked in the GRC and cybersecurity space for over 20 years across multiple industries and organizations of different sizes. He specializes in a collaborative approach to GRC and cybersecurity, showing customers how to work across the entire organization to achieve business goals. Connect with Alan on LinkedIn.

You may also like to read

Shadow AI: Audit privacy risks in your data supply chain

IT vendor risk management: Best practices for managing third-party tech risk

The ultimate vendor risk assessment checklist for compliance teams

Shadow AI: Audit privacy risks in your data supply chain

IT vendor risk management: Best practices for managing third-party tech risk

Discover why industry leaders choose AuditBoard

SCHEDULE A DEMO