May 27, 2022 • 7 min read

Hyperautomation in Action: Revenue and Receivables

Process-level automation — also known as hyperautomation — involves the orchestrated use of multiple technologies to automate as many business and IT processes as possible. According to predictions from Gartner, McKinsey, and Deloitte, hyperautomation is one of the top technology trends of 2022.

In our Internal Audit Hyperautomation Blueprint Series, authors Brett Luis and Joe Kim explore examples of business processes typically selected for SOX and internal audit testing that contain many opportunities for hyperautomation. Download your free copy of our second whitepaper in this series — which explores opportunities in the quote-to-cash lifecycle — and read on below for an overview of how to incorporate RPA, Advanced Analytics, Data Visualizations, and API/IPaaS in quote-to-cash, including:

- Discovery Analytics/Data Profiling

- ICFR Automated Evidence Collection, Testing, and Data Visualization Procedures

- Fraud Detection Techniques

Revenue and Receivables Process Overview

The quote-to-cash (QTC) or order-to-cash (OTC) process encompasses a broad range of activities that form the lifeblood of revenue-generating organizations. While QTC and revenue recognition policies may vary by industry and across organizations, most businesses can recognize areas for improvement. The underlying pain points in the QTC lifecycle typically stem from an organization having too many disparate systems with disaggregated data requiring human intervention to resolve issues and interruptions to the process. There may be separate order management systems, inventory management systems, enterprise resource planning (ERP) systems, invoicing systems, and payments systems that do not effectively communicate with one another in real time.

Given the large transaction volumes, data, and inherent complexity typical to QTC, this process is an ideal starting point for management and audit teams to implement hyperautomation technologies. Advanced analytics, data visualization, and RPA can be leveraged to streamline order management and fulfillment, credit management, and payment collection, in addition to optimizing cash flow and improving fraud identification.

Overview of Systems and Data Files Typical to Quote-to-Cash

The following is an overview of the systems and data files used across the revenue and receivables lifecycle.

Common Systems Used to Process Revenue and Receivables Transactions

- Core ERP systems such as Oracle and Netsuite

- Other systems that specialize in accounts receivable, order management, inventory, etc.

- Accounting and financial software e.g., Sage, Workday, Quickbooks

Examples of Source Data/Input Files Used in Automation Procedures

- Sales agreements/contracts

- Quotations

- Customer master file and log of changes

- Credit limits and log of changes

- Sales orders

- Subscriptions

- Accounts receivable aging

- Invoice/billing transactions

- Credit memo

- Price lists

- Sales commissions

- See eBook for full list

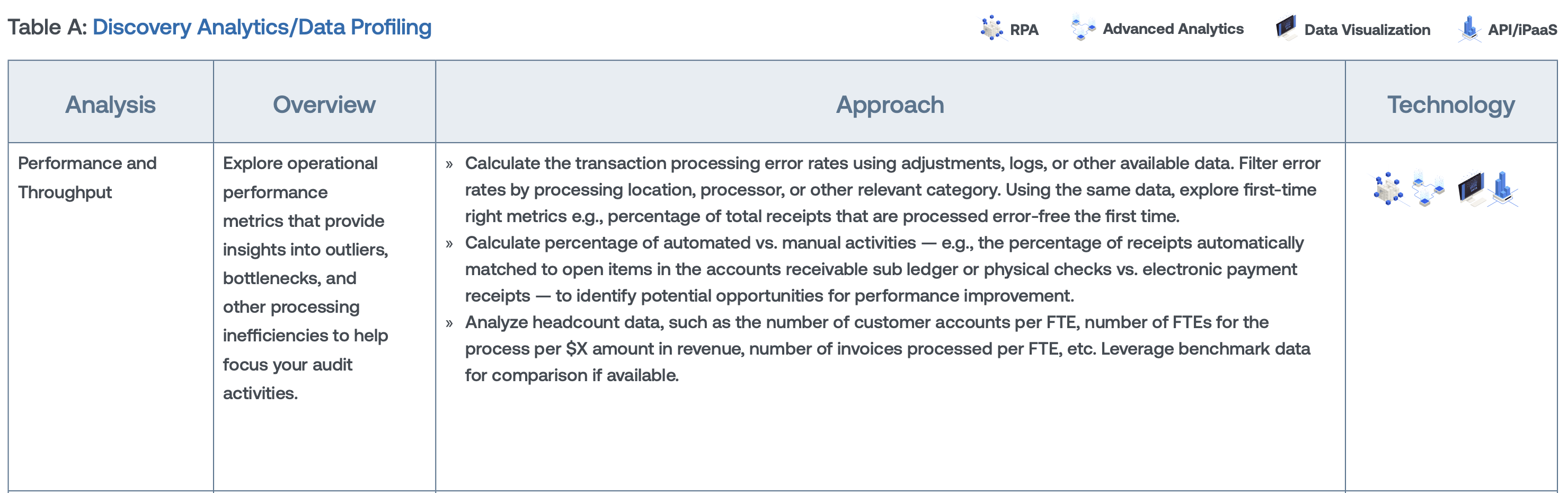

Example A: Discovery Analytics/Data Profiling

Help scope the nature, timing, and extent of your procedures and support your risk assessment using QTC-focused discovery audit analytics. Leveraging your sales, order fulfillment, service delivery, and accounts receivable function’s existing dashboards, analytics, or technologies — like process mining — can provide valuable insights into sales pipeline and trends, customer risk profiles, transaction processing volumes, error rates, and opportunities for efficiency. If your quote-to-cash functions have not conducted transformational initiatives like pricing and promotion analytics, customer profiling, and automation, you will likely identify significant value-add observations conducting your own discovery analysis. The following is an example procedure you can use to help understand the business process, uncover insights, and substantiate the objectives and focus of your audit.

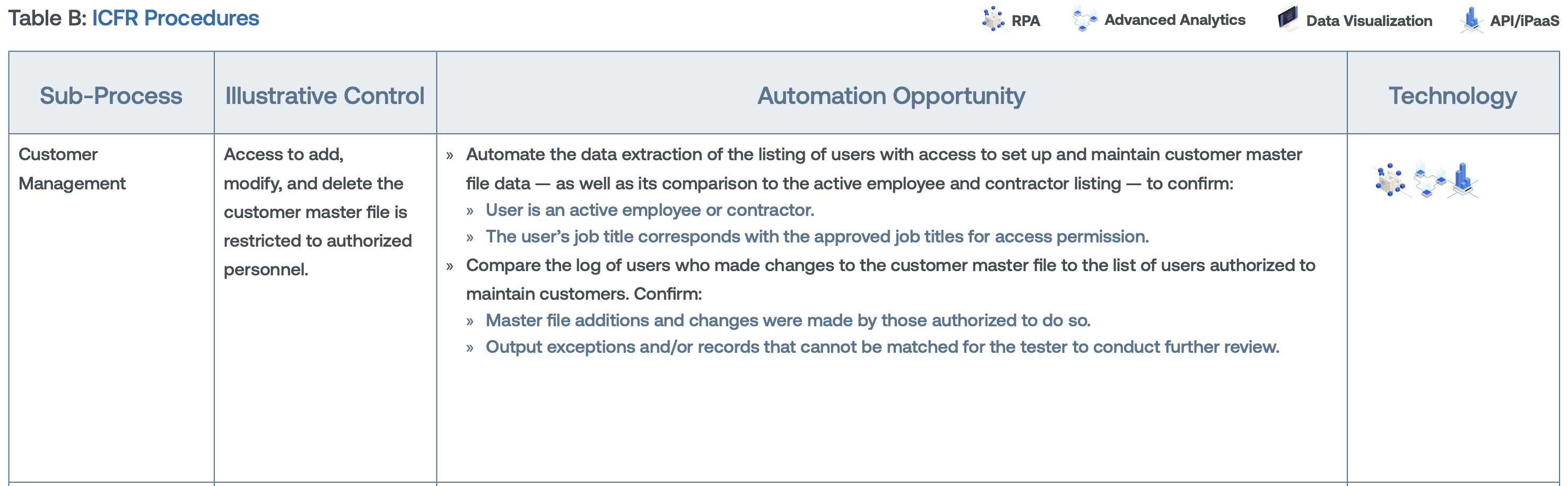

Example B: ICFR Automated Evidence Collection, Testing, and Data Visualization Procedures

Traditional quote-to-cash cycle internal control testing procedures offer an array of opportunities to leverage technology to improve coverage, accuracy, and efficiency. By pursuing continuous auditing — through automating evidence collection and suitable testing procedures — audit teams are empowered to focus their resources on higher-value tasks, reducing audit fatigue and ultimately transforming their processes by eliminating non-value-add manual tasks. The following is an example of using automation in your ICFR coverage.

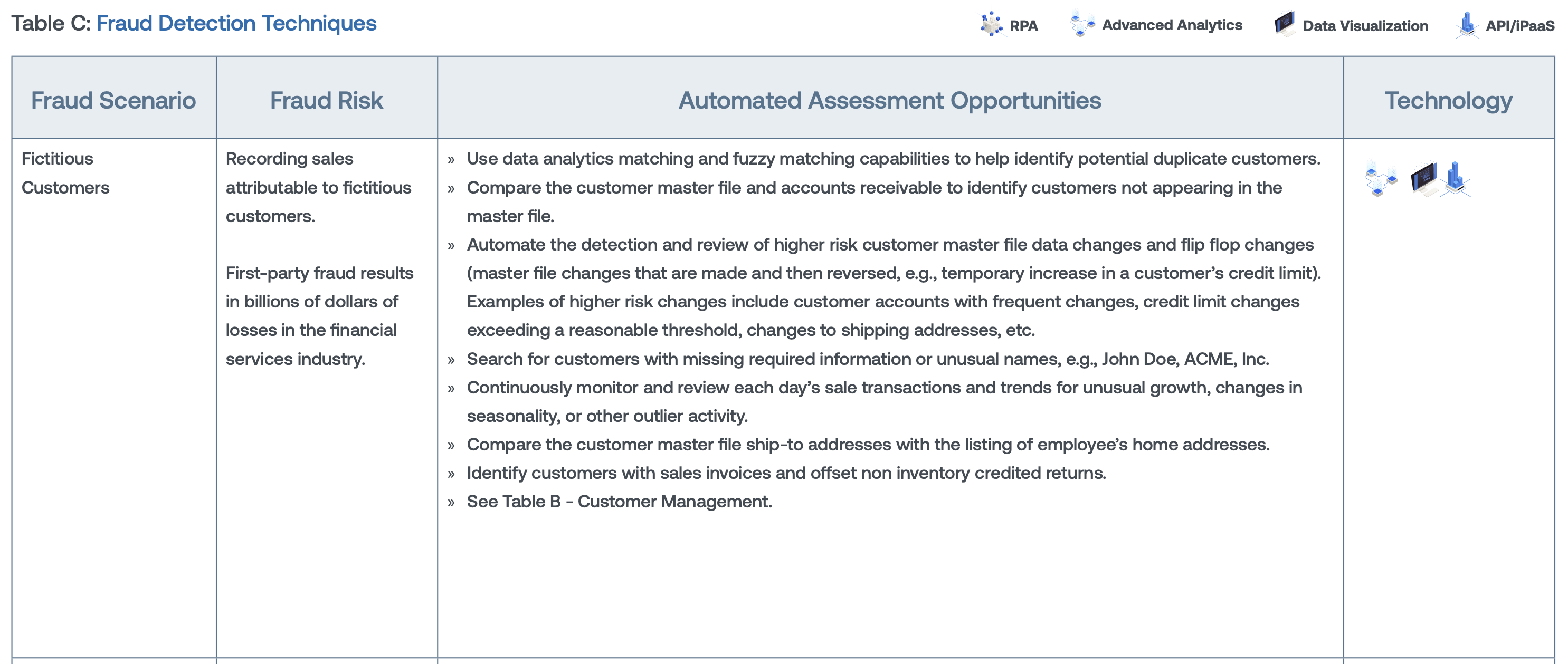

Example C: Fraud Detection Techniques

The paradox created by the tremendous benefits of new technologies weighed against their increased risk is apparent when we analyze recent transformational quote-to-cash technology and process improvements. Fraud schemes to overstate revenue and shore up share prices have led to some of the largest financial losses in history. Before, such schemes often went undetected due to their inherent complexity, sophistication level of their perpetrators, and collusion. However, with increased access to data and robust analytics solutions, audit teams are better positioned than ever to tackle the detailed analysis required to surface these schemes.

The following is an example of how internal audit teams may leverage hyperautomation technologies to help detect quote-to-cash fraud schemes.

For the full guide including the most impactful automation opportunities across the revenue and receivables lifecycle, download our whitepaper: Internal Audit Hyperautomation Blueprint: Revenue and Receivables. Stay tuned for further installments of our Internal Audit and Hyperautomation Blueprint Series that will explore opportunities across other SOX and audit business processes.

You may also like to read

AuditBoard and IAF report: The more you know about AI-enabled fraud, the better equipped you are to fight it

Audit reporting best practices: Guide for audit leaders

Boards are struggling with AI oversight. How internal auditors can help

AuditBoard and IAF report: The more you know about AI-enabled fraud, the better equipped you are to fight it

Audit reporting best practices: Guide for audit leaders

Discover why industry leaders choose AuditBoard

SCHEDULE A DEMO