November 15, 2024 • 15 min read

Effectively Managing Risk Across Your Organization: 3 Key Strategies

Mary Tarchinski Krzoska

Enterprise risk encompasses regulations, finance, operations, technology, reputation, strategy, and many more — and losing control over any one of these risk areas could mean disaster. Lately, with the increased focus on strong governance requirements, there is more scrutiny over risk management programs. This article will share insights on three holistic risk management strategies organizations use to meet modern governance expectations.

1. Gain Executive Understanding by Breaking Down Knowledge Silos

Executive support is essential to the success of any program — and a key ingredient in gaining executive support is to make sure they understand what you are trying to tell them. While this sounds easy in theory, one of the most common challenges in managing risk across the enterprise is successfully ensuring your executives are bought into those risks.

In order to break down silos with your executive team, it is important to find common ground. Risk leaders can do their part to bridge the gap by taking care to advise executives in a way that will be easy for them to understand — and take action on. Here are a few ways to get your executive teams on the same page as risk management:

- Report concisely on what is relevant to the executive team, using pertinent and actionable supporting data.

- Contextualize technical information within an executive’s business-focused needs.

- Use KPI data to make your case in budgetary discussions.

- Share data that demonstrate the ROI on risk mitigation activities to make the business case for the budget to support your initiatives.

- Present risk findings in terms of business risk and market trends in order to shape the conversation that marries security and business goals.

When framing risk to gain executive buy-in, remember that storytelling is key — and it’s both an art and a science. What is this risk? Why is it important? Are we asking you, the executive, for support or action? What are we doing or going to do to manage it — or exploit it?

The conversations can be either formal or informal, depending on your culture and the extent of your organization’s silos. They may be part of regular updates in risk management, especially when discussing risk responses or projects that require considerable effort. For example, many public companies have implemented controls around Environmental, Social, and Governance (ESG) disclosure reporting. Risk managers knew the risk topic would impact their companies, so many began socializing the idea and probable controls well in advance so that other stakeholders would be comfortable once the requirements went into effect.

2. Centralizing Risk Management

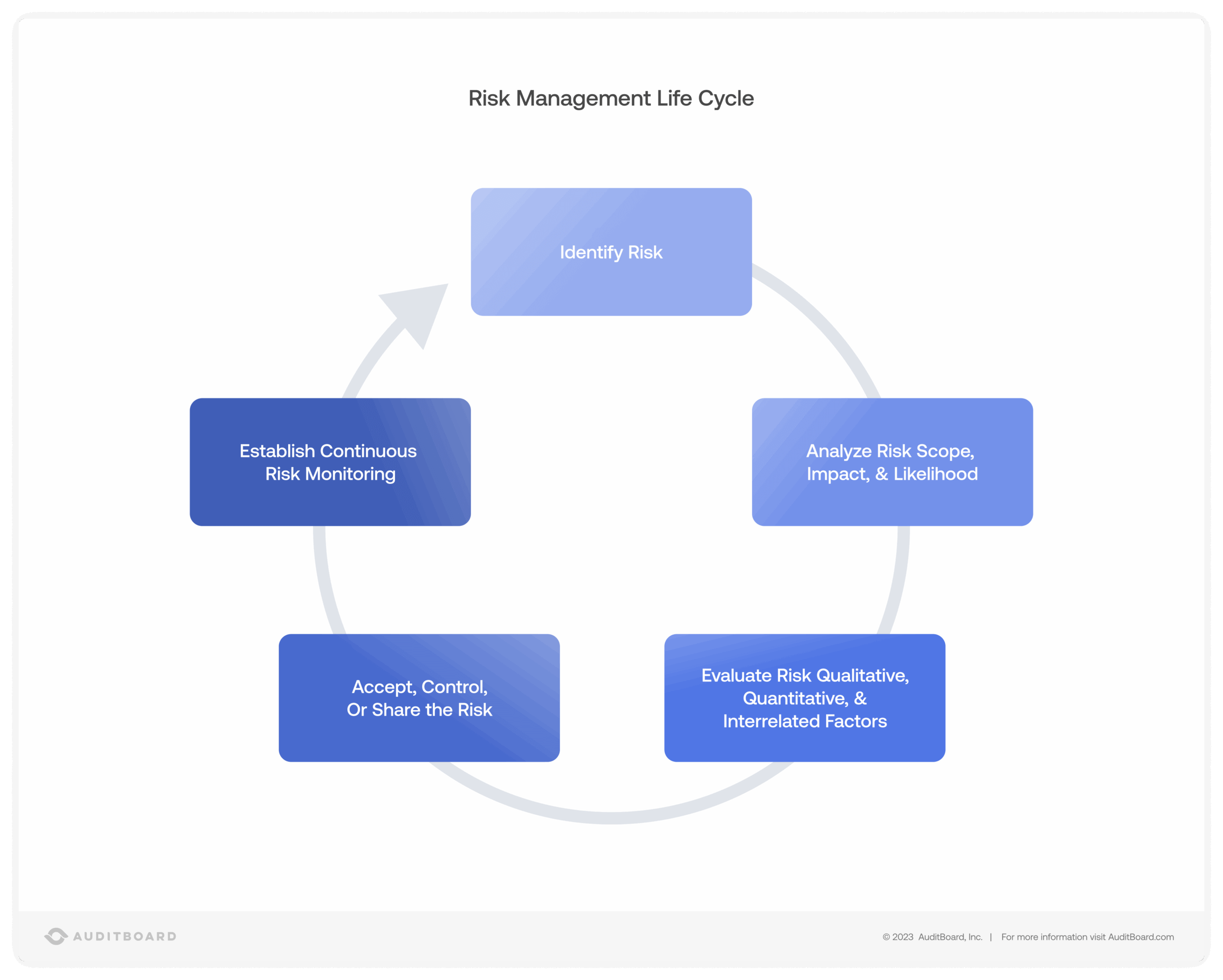

A centralized risk management function can consolidate adherence to a governance life cycle. In most risk scenarios, we can apply a consistent five-step life cycle:

- Identify Risk

- Analyze Risk Scope, Impact, & Likelihood

- Evaluate Risk Qualitative, Quantitative, & Interactive Factors

- Accept, Control, or Share the Risk

- Establish Continuous Risk Monitoring

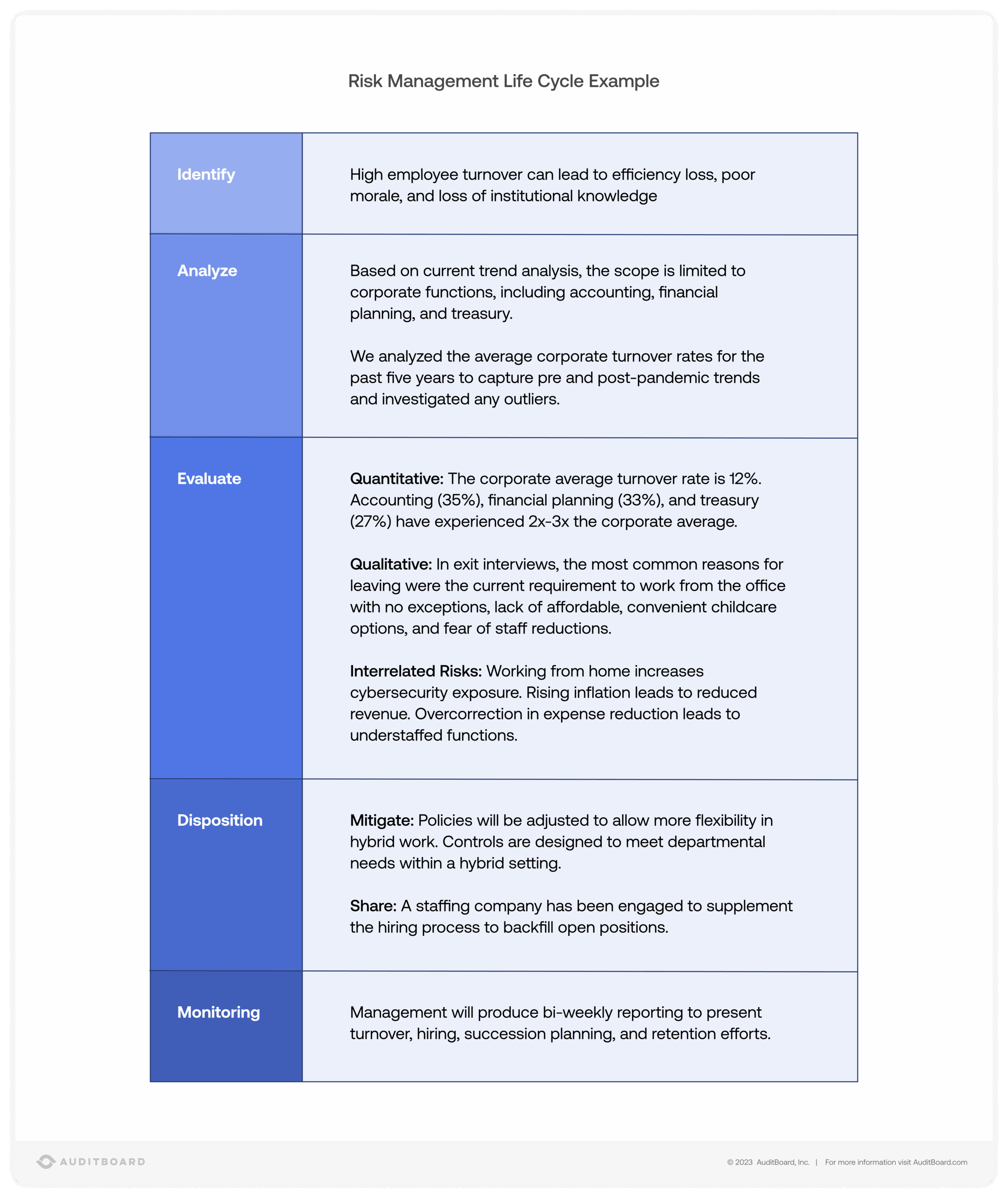

As an illustration, a company may identify high employee turnover as a risk and use the lifecycle model to think through the impact on their organization.

1. Identify

- High employee turnover can lead to efficiency loss, poor morale, and loss of institutional knowledge.

2. Analyze

- Based on current trend analysis, the scope is limited to corporate functions, including accounting, financial planning, and treasury.

- We analyzed the average corporate turnover rates for the past five years to capture pre and post-pandemic trends and investigated any outliers.

3. Evaluate

- Quantitative: The corporate average turnover rate is 12%. Accounting (35%), financial planning (33%), and treasury (27%) have experienced 2x-3x the corporate average.

- Qualitative: In exit interviews, the most common reasons for leaving were the current requirement to work from the office with no exceptions, lack of affordable, convenient childcare options, and fear of staff reductions.

- Interrelated Risks: Working from home increases cybersecurity exposure. Rising inflation leads to reduced revenue. Overcorrection in expense reduction leads to understaffed functions.

4. Disposition

- Mitigate: Policies will be adjusted to allow more flexibility in hybrid work. Controls are designed to meet departmental needs within a hybrid setting.

- Share: A staffing company has been engaged to supplement the hiring process to backfill open positions.

5. Monitoring

- Management will produce bi-weekly reporting to present turnover, hiring, succession planning, and retention efforts.

Centralizing the risk management lifecycle and following a model like this example enables a better comparison of risks across the organization and consistent treatment of the risks in line with management’s risk appetite.

3. Integrating Governance Frameworks

Organizations have to monitor and comply with many frameworks. Within an IT function alone, there are laws and regulations to follow and standards like NIST, SOC, ISO, SOX, PCI, COBIT, and others that all require simultaneous compliance. Keeping the requirements updated, tested, and monitored is a huge undertaking.

One of the best strategies for complying with multiple frameworks is to create an integrated matrix that combines all of the frameworks so teams can take advantage of overlapping requirements and controls. This will help your team not only save time with managing their compliance program, but will also allow for an integrated approach across compliance teams. Having an integrated approach across compliance teams is crucial in staying ahead of the new regulations and monitoring which ones are relevant to your company.

With so many frameworks, consider bringing in a technology solution with a fully integrated and intuitive platform to manage all your frameworks — gaining valuable efficiency by eliminating redundant testing.

4. Regulatory Changes and Their Impact on Risk Management

Regulation keeps changing, and businesses are feeling the impact. New rules like GDPR updates have restricted how companies handle personal data. Violate this policy and a company is looking at hefty fines or a public relations nightmare. In finance, SOX (Sarbanes-Oxley) is piling on with stricter controls over financial reporting, and it’s not just more paperwork. Ignoring these changes isn’t an option unless you’re willing to risk penalties, damaged reputation, and your customers’ trust. While keeping up is difficult, falling behind is much worse.

Juggling compliance with overlapping frameworks like PCI DSS for credit card processing or NIST for cybersecurity in the healthcare field? That’s where it gets messy. Each framework has its own rules, and the more you try to keep up, the more chaotic it gets. The solution? Centralize. Find one system to manage all those moving parts. Platforms that connect everything in one place can simplify the chaos. Automating tasks, like tracking regulatory updates or testing controls, saves time and keeps everyone on the same page. You’ll cut out extra work and focus on the risks that really matter.

But here’s the thing: compliance isn’t just about dodging fines. It’s your chance to step up and get ahead. Take ESG reporting—it’s not just about ticking boxes; it’s about showing the world you care about the future. Nail your data protection policies, and you’re not just compliant—you’re building trust with your customers. Turning these challenges into opportunities is what separates companies that survive from those that thrive. When regulations shift, smart businesses don’t panic—they adapt. They use regulation changes to get ahead of the pack.

Connecting Risk Across Your Organization

Adopting a holistic view of organizational risks from a centralized risk management function brings consistency to risk mitigation initiatives, the way risks are treated, and the ability to manage multiple requirements simultaneously. The strategies presented in this article are proven to increase management buy-in for upcoming projects while reducing redundant control and testing efforts. Learn more about AuditBoard’s connected risk platform designed to meet modern governance expectations.

AuditBoard offers a comprehensive, cloud-based platform that streamlines various aspects of risk management, audit, and compliance. Its intuitive interface and robust features enable organizations to efficiently identify, assess, and mitigate risks across the enterprise. By centralizing risk data and providing real-time analytics, AuditBoard facilitates informed decision-making and promotes a proactive approach to risk management.

Frequently Asked Questions about Managing Organizational Risk

What are the four main steps an organization takes to manage risks?

The risk management process typically involves four key steps:

- Identify Risks: Pinpoint potential risks that could impact the organization, such as financial, operational, regulatory, or strategic risks.

- Assess Risks: Evaluate the likelihood and impact of each identified risk, often using qualitative and quantitative analysis.

- Mitigate Risks: Develop and implement strategies to reduce, transfer, or eliminate risks, such as adopting new controls, purchasing insurance, or outsourcing high-risk activities.

- Monitor Risks: Continuously track and review risks to ensure they are effectively managed and adjust strategies as new risks emerge or existing ones evolve.

What are some effective risk management strategies for organizations?

Organizations can use several strategies to manage risks effectively, including:

- Centralizing Risk Management: Consolidating risk data and decision-making within a unified framework to ensure consistency and visibility across the organization.

- Leveraging Technology: Using tools like risk management software to automate processes, track compliance, and provide real-time insights.

- Integrating Governance Frameworks: Aligning compliance efforts with frameworks like ISO 27001, NIST, and PCI DSS to streamline operations and avoid redundancy.

- Developing a Risk-Aware Culture: Training employees to recognize and respond to risks proactively while aligning their actions with organizational goals.

- Scenario Planning: Preparing for worst-case scenarios by identifying potential crises and creating response plans to minimize disruption.

What are the benefits of enterprise risk management (ERM)?

Enterprise risk management (ERM) provides numerous benefits, including:

- Improved Decision-Making: ERM offers a comprehensive view of risks across the organization, enabling leaders to make informed, strategic decisions.

- Operational Efficiency: Centralizing risk management reduces redundancies and streamlines compliance, saving time and resources.

- Regulatory Compliance: ERM ensures alignment with legal and regulatory requirements, helping organizations avoid penalties and reputational damage.

- Enhanced Resilience: By identifying and mitigating risks early, ERM helps organizations respond effectively to disruptions and recover more quickly.

- Stakeholder Trust: Demonstrating strong risk management practices builds confidence among investors, customers, and employees.

What is meant by business risk?

Business risk refers to the potential for a company to experience losses or disruptions due to factors that impact its operations, profitability, or overall success. These risks can arise from both internal and external sources, such as:

- Internal Factors: Poor management decisions, operational inefficiencies, or inadequate financial planning.

- External Factors: Economic downturns, market competition, changing regulations, or natural disasters.

Managing business risk involves identifying these potential issues, assessing their impact, and developing strategies to minimize their likelihood or mitigate their effects. Effective risk management ensures that a business can adapt to challenges and sustain its operations over the long term.

About the authors

Mary Tarchinski Krzoska, CISA, is a Market Advisor at AuditBoard. Mary began her career at EY before transitioning to a risk and compliance focus at A-LIGN, and brings 9 years of global experience including SOC, HIPAA and ISO compliance audits, consulting on business continuity and disaster recovery processes, and facilitating risk assessments. Connect with Mary on LinkedIn.

You may also like to read

What is a model card report? Your guide to responsible AI

GRC survival guide: Thriving in the era of AI SaaS

An executive’s guide to the risks of Large Language Models (LLMs)

What is a model card report? Your guide to responsible AI

GRC survival guide: Thriving in the era of AI SaaS

Discover why industry leaders choose AuditBoard

SCHEDULE A DEMO